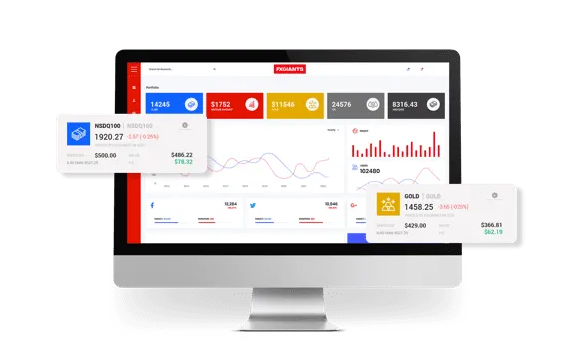

The world of investing can be intimidating, especially with so many different options available. One such option that has gained a lot of traction recently is Cfd trading. If you’re looking to explore new investment avenues, Cfd trading may be a viable option for you. CFDs or Contracts for Difference offer traders a chance to speculate on financial markets, without actually owning the underlying asset. In this blog post, we’ll be diving deeper into the world of cfd trading, and exploring its profit potential.

What are CFDs?

CFDs or Contracts for Difference are a type of derivative trading. They’re exchanges between two parties- the buyer and the seller- where the buyer agrees to pay the seller the difference between the asset’s current value and its value at the time of the contract’s closure. The underlying asset could be anything from currency pairs to commodities, indices, or stocks. It’s a very flexible investment type that gives you an opportunity to trade on a lot of different markets.

How Cfd trading Works:

Cfd trading offers the trader a chance to speculate on the future movement of an asset’s price, whether it goes up (Going Long) or down (Going Short). For example, suppose you believe that the price of a company’s stock is going to rise. In that case, you may purchase a CFD contract that allows you to speculate on the underlying asset’s price. If you’re right, the profits are yours. However, if the price moves against you, you’ll face losses. Cfd trading also gives traders a chance to leverage their trades, meaning you can increase your position size with just a fraction of the actual asset’s cost.

The Advantages of Cfd trading:

One of the biggest advantages of Cfd trading is the flexibility it offers. You can trade on a wide range of markets and even go short if you think the price is going to fall. Additionally, CFDs allow leverage, so you can increase your position size with only a small percentage of the actual asset value. This characteristic means that you can potentially secure higher profits while keeping your risk relatively low. Furthermore, unlike traditional investment methods like buying shares, CFDs are exempt from various taxes, such as stamp duty, which can save you a significant amount of money.

The Risks of Cfd trading:

Despite the advantages, Cfd trading does come with its own set of risks. As mention earlier, leveraged trading can help you secure higher profits, but it can also increase your losses. Traders should always consider their risk appetite before starting to trade. Additionally, relying solely on trends or speculations can lead to significant losses. Cfd trading requires a lot of research and study to understand the market factors that can influence the assets you’re dealing with.

short:

In short, Cfd trading is an excellent opportunity for traders to speculate on multiple markets that they might not typically have access to through traditional investing. Its flexibility and leverage options can be beneficial for those who are willing to research and plan their trades. However, it’s important to remember that while investing in CFDs can bring in significant profits, it can also lead to significant losses. Always have a well-planned investment strategy and conduct due diligence before entering the CFD market. Happy trading!